33. New Scorecard Tracks Climate Action Among U.S. Regulatory Agencies

As integrating climate risk becomes increasingly important for creating more sustainable, prosperous, and resilient capital markets in the face of climate-related financial risk, all eyes are on U.S. regulatory agencies for what comes next in their efforts to take action.

Scoring Regulatory Action

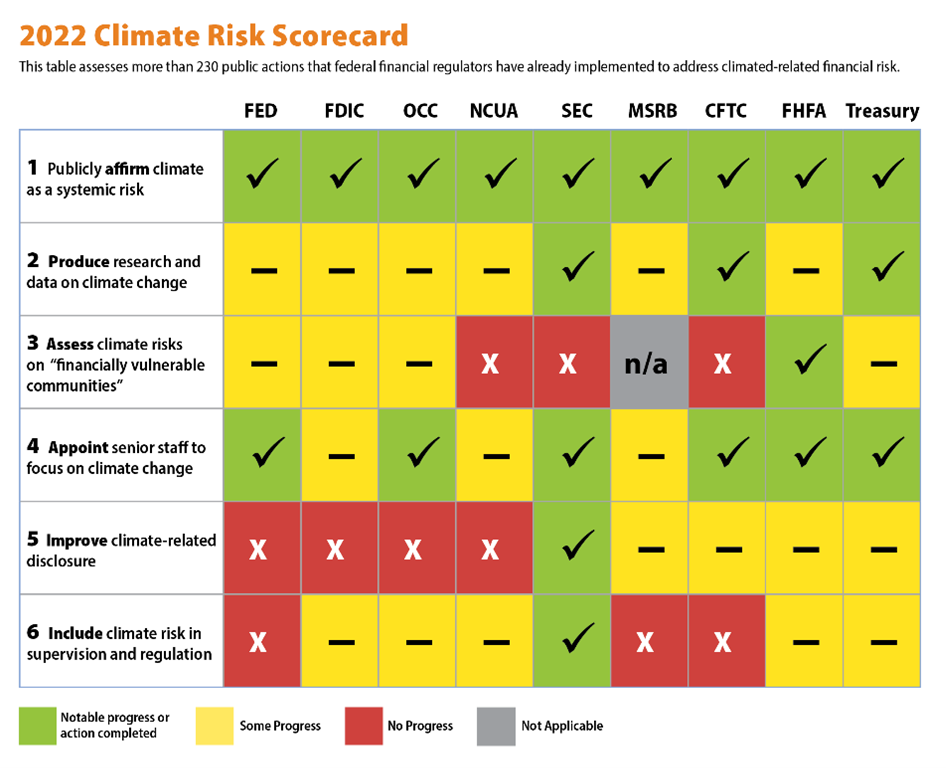

At the end of June, Ceres Accelerator for Sustainable Capital Markets released their 2022 Climate Risk Scorecard, which assesses actions from nine federal agencies as it relates to protecting and mitigating climate-related financial risks to capital markets and institutions.

The nine agencies whose actions are tracked on the scorecard are as follows: the Federal Reserve Bank (The Fed), the Federal Deposit Insurance Corporation (FDIC), the Office of the Comptroller of the Currency (OCC), the National Credit Union Administration (NCUA), the U.S. Securities and Exchange Commission (SEC), the Municipal Securities Rulemaking Board (MSRB), the Commodity Futures Trading Commission (CFTC), the Federal Housing Finance Agency (FHFA), and the U.S. Department of the Treasury.

According to the scorecard, these nine agencies have taken a total of over 230 unique actions to address climate-related financial risks. Notably, while every agency has affirmed climate change as a systemic risk and a majority have appointed dedicated staff to focus on the issue, many of the agencies are still failing to produce climate research and data, improve climate-related disclosures, and include climate risk in supervision and regulation.

Progress to be Made

Ceres’ 2022 Scorecard comes on the heels of the SEC considering more stringent regulations around disclosing climate risks and serves as an update from their original scorecard published in April 2021, where they determined these agencies were behind the curve when it comes to climate action. While regulators have made significant progress over the last year, Ceres says “the current view of these risks is incomplete, and U.S. agencies still lag far behind their foreign counterparts in accounting for and addressing these risks.”

In their executive summary of the Scorecard, Ceres additionally notes that “only one agency, the Federal Housing Finance Agency (FHFA), has made notable progress on addressing the impacts of climate change on financially vulnerable communities.” It’s well-known that low-income communities and communities of color – which are often also categorized as financially vulnerable communities – shoulder a disproportionate burden of climate impacts and will continue to do so as the impacts grow in frequency and severity. Creating resilient and sustainable capital markets and communities requires continued innovation on behalf of regulatory agencies and institutions to address the impacts of climate change.

For banks and financial institutions thinking about increased regulation and looking to get ahead of the curve when it comes to climate action, partnering with Sunwealth allows banks to leverage capital to combat both climate change and inequality. Our approach prioritizes developing solar projects in low- to moderate-income communities and communities of color – those that are often more financially vulnerable to climate impacts – to deliver solar access, energy savings, emissions reductions, and green jobs, that create meaningful community impact and strong financial returns.

Whatever your view on the role of U.S. financial regulators with regard to the assessment and disclosure of climate risk, Ceres – whose Investor Network is comprised of 220 financial institutions managing more than $60 trillion in assets – exemplifies the steady and deep pocketed efforts to increase regulatory requirements for financial disclosure and accountability related to climate risk.

Check out the 2022 Ceres Climate Risk Scorecard here.

Get in touch to learn more about partnering with Sunwealth.

Christian Morris is a Marketing and Investor Development Associate. Prior to joining Sunwealth, he led communications for a Boston-based research and advocacy nonprofit focused on climate policy.