26. The Regulators Strike Back

“All banks may have material exposures to climate-related financial risk.”

– the Office of the Comptroller of the Currency

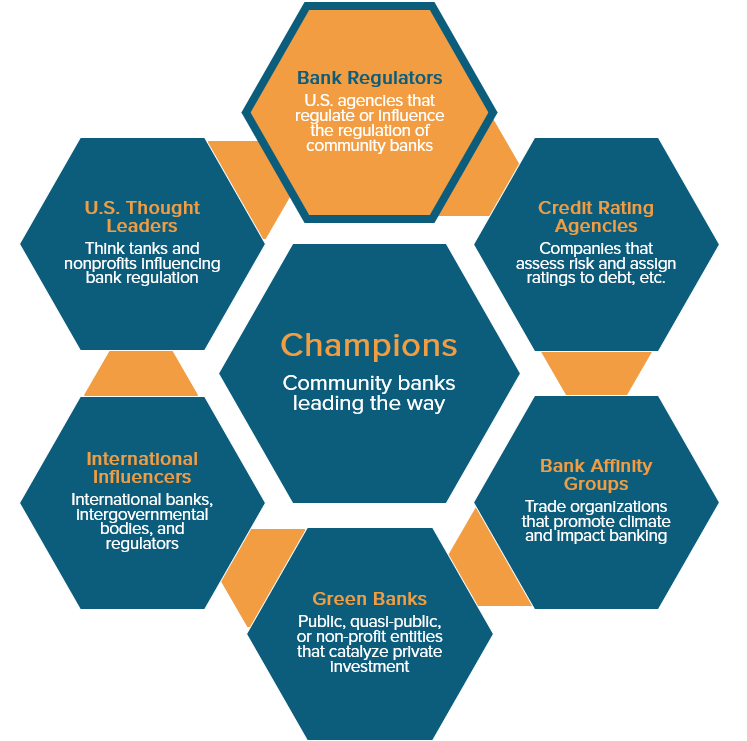

Signals from the Regulators

On November 17th, 2021, we introduced the bank regulators sending signals that climate-risk regulation is on the horizon. Recall that on March 15th, 2021, the Securities and Exchange Commission (SEC) opened comments on existing Climate Change Disclosures on corporate issuers. The comment period closed 90 days later-- 3 out of every 4 responses supported mandated disclosures. While the SEC works on a proposal, another regulatory agency has sent a signal of its own.

OCC Open for Comments

On December 16th, 2021, the Office of the Comptroller of the Currency (OCC) announced, “Banks are likely to be affected by both the physical and transition risks associated with climate change.” They then proceeded to seek feedback on their published draft of principles designed to support the identification and management of climate-related financial risks. Although these principles target banks with over $100 billion in total consolidated assets, the OCC did not hesitate to warn community banks of their material exposures to climate-related financial risk. The comment period remains open until February 14th, 2022-- they have already received 3,429 responses.

OCC Doubles Down with Climate Survey

In November 2021, the head of the OCC outlined a series of climate change-related questions to the boards of directors of OCC-regulated banks. The Climate Survey serves as an exercise to improve and build upon climate risk management and reporting capabilities. Question 12 implies that banks should consider climate risk when pricing financial products. The feedback from the public and the Climate Survey align in that they indicate plans for mandated climate-related disclosures from public companies.

If you’d like to learn about the OCC’s comment process and see what stakeholders are saying, click here.

Sunwealth will monitor actions from regulatory agencies and send updates accordingly

Andrew Hollander joined Sunwealth as an Associate shortly after graduating from Bentley University. He is amped to put his degree to work and motivated to create a clean energy future for all. When he’s not managing solar assets, he can be found watching Seinfield or spending time with friends and family.