4. It’s A Wonderful Life: A Tax Equity Investment with Sunwealth

By Jon Abe, Chief Executive Officer

In the fourth installment of our Banking on Solar series, we review the lifecycle of a Sunwealth Tax Equity investment. To start at the beginning of the series, read Banking on Solar.

Solar tax equity is a large and growing investment opportunity, but it has a reputation for being complicated and the domain of megabanks.

The time and capital of our local community banks are valuable and Sunwealth understands this. We believe that a solar tax equity investment with Sunwealth should be highly considered or a part of every community bank’s portfolio, especially as community-based solar becomes an increasingly efficient way to put capital to work to grow community-based clean energy economies and address climate change.

Community banks invest in Sunwealth Tax Equity in part because of the risk-reward of our product, track record, generational commitment, and focus on community impact. More importantly, community banks invest because of our devotion to simplifying the tax equity investment process for them, making it worth their while.

It Begins with a High-Quality Portfolio of Impact Solar Projects

Sunwealth continually and diligently originates and underwrites community-based solar projects directly with property owners and highly qualified solar development and installation partners. These partners typically have a minimum of five years of experience, have completed at least 5 megawatts of commercial solar projects, have licensed electricians, general contractors and professional engineers on their teams, and are well-respected and involved in their local communities.

Prior to any project investment, projects must go through our underwriting process, summarized below:

Project Design. The project must use Sunwealth’s preferred equipment (such as Bloomberg Tier 1 Solar Equipment) and the design must be completed and approved by a professional engineer for optimal efficiency, best practices, and consideration of the local property characteristics.

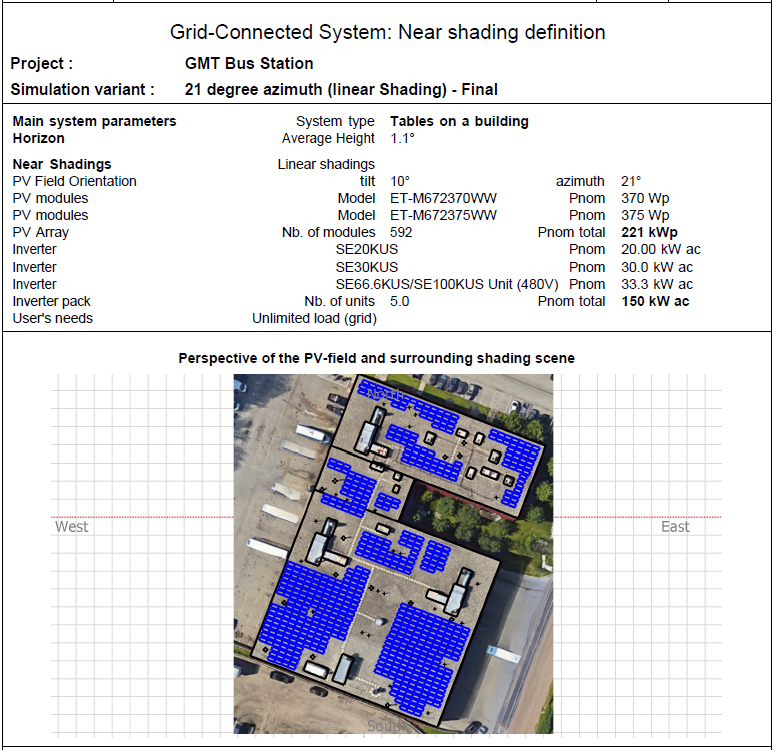

Production Model. The project electricity production must be modeled using a Sunwealth vetted third‐party tool and appropriately account for the project design and related variables, such as orientation and shading.

Site. The site must be determined to be suitable for the solar project by a qualified professional, such as a professional engineer. For example, on a rooftop project, this involves verification that the roof, structure, and points of interconnection are suitable.

Credit. Sunwealth’s credit review process involves five steps to evaluate the likelihood of the power customer’s ability to benefit from the project and make timely payments during the life of the power purchase agreement. All projects must provide meaningful savings to our hosts and customers to pass underwriting.

Contracts. Sunwealth’s standardized agreements streamline the contracting process. Each project’s power purchase agreement, site lease/license, EPC (engineering, procurement, and construction) agreement, and operations and maintenance agreement must meet Sunwealth’s standards.

Entitlements. The project must qualify as appropriate for all applicable federal and state entitlements and incentives prior to financing.

Interconnection and Permits. All applicable interconnection agreements and non‐ministerial permits must be secured by each project prior to financing.

Social Impact. Each project is evaluated both for social impact and to ensure that the project will not do any harm or have any unintended consequences.

Financial Returns. Finally, each project must emerge from the development process with deal characteristics that continue to meet or exceed Sunwealth’s requirements for providing our project investors with simple, safe and profitable investment opportunities.

An excerpt from a PV System Report showing how shading is incorporated into the assessment of a potential solar site.

Once a solar project meets the above criteria, it is deemed shovel ready and ready to build. At this stage, Sunwealth shifts gears from underwriting to construction and asset management.

Construction Management. Sunwealth works closely with our trusted installers and engineering partners to build and commission each system. We monitor and inspect construction progress and ensure that each system is built to specification and tested as part of the Placed in Service process.

Asset Management. For the project life, Sunwealth monitors project performance in real-time and work closely with our operations & management partners to ensure that every project is regularly inspected and maintained to optimize performance, longevity, and safety. Sunwealth also directly performs the backroom functions for each project to ensure revenue is optimized, expenses are paid, and risks are managed.

An example of a dashboard Sunwealth uses to monitor the performance, longevity and safety of a solar project.

To date, Sunwealth has underwritten, built, and currently manages 150+ solar projects representing over $50 million of investment. For every $1 million of projects that we build, we efficiently evaluate over $25 million of potential projects. Our disciplined approach to underwriting and managing our solar portfolio has resulted in 23 quarters of meeting or exceeding target returns to investors while maintaining zero project defaults. At the same time, we have not compromised when it comes to community impact. We have partnered with over 25 leading local and regional solar installers, creating 400+ solar job years. Our projects are structured to provide $30 million in clean energy savings to our project site hosts, solar electricity customers and their communities.

Sunwealth’s ground-mounted solar installation on land owned by Holyoke Gas & Electric in Holyoke, MA will deliver over $550K in lifetime energy savings to the Holyoke Housing Authority.

And Continues with a Streamlined Tax Equity Investment Process

Sunwealth provides a simplified and streamlined tax equity investment process for community banks, the foundation of which is strong underwriting and management of a growing, performing solar portfolio. Every Sunwealth Tax Equity investment follows the same general lifecycle:

Mutual Learning. Every tax equity conversation with Sunwealth begins with a thorough understanding of solar tax equity, a discussion of each other’s goals, and the benefits of partnering with one another.

Proposal. Your time is valuable. We have a standard, rolling Sunwealth Tax Equity offering and are ready to share proposal details, an indicative model and documentation at an early stage. Tax equity investing is very much a team effort and Sunwealth’s team of experts stands ready to go into depth with community banking teams, whether it is a project, underwriting, financial model, or accounting discussion.

Documentation and Closing. Sunwealth has a time-tested standard offering and full document set, including an LLC Agreement that supports efficient and thorough documentation, review, and closings with community banks.

Investment Milestones. We do not call on tax equity capital until the project requiring the funding has achieved mechanical completion and is relatively close to being ready for Placed in Service.

Reporting and Customer Service. Sunwealth regularly reports on the financial and impact performance of its offerings, as well as issues LLC K-1s promptly each year. We regularly share stories and public relations opportunities that emerge from our newsworthy impact solar projects. We provide exceptional customer service and respond to questions and requests throughout the life of the investment and beyond. We have met or exceeded every Sunwealth Tax Equity LLC target return to date.

Programmatic. The tax equity investment lifecycle is just over five years. Many of Sunwealth Tax Equity investors are programmatic investors, meaning that they invest year after year or sometimes multiple times each year to achieve greater return efficiency and volume.

In the words of esteemed community banker George Bailey from the classic movie, It’s a Wonderful Life,

“I know what I'm gonna do tomorrow, and the next day, and the next year, and the year after that.”

At Sunwealth, we know what to do to build and manage solar projects that perform for the long haul. We’re committed to working alongside community bank partners to get the job done and add the benefits of solar to our communities for generations to come.

Read the next post in our Banking on Solar series: Highlights from the Massachusetts Bankers Association’s 2020 Renewable Energy Summit.

Return to the homepage to check out our other Banking on Solar blog posts.

Want to learn more about solar tax equity investing? Reach out to Darreck Mitchell at darreck@sunwealth.com.

Jon Abe is Chief Executive Officer at Sunwealth. He has over 20 years of experience developing, building and managing solar and distributed energy resources and working with community banks to finance the growing solar economy. Jon also is proud to help green and electrify his community as a member of the Belmont Light Advisory Board.