21. Climate-risk Regulation: What to expect

While the Fate of Build Back Better is Uncertain…

Bank Regulators Will Drive More Climate-Risk Regulation

by Omar Blayton

While we await the final form and passage of the reconciliation bill (Build Back Better Act), the Biden administration has been pushing Bank Regulators to author more stringent guidelines and regulations regarding the assessment, disclosure, and mitigation of climate risk by banks and other companies. While the Build Back Better Act faces tight margins in both the House and Senate, recent regulatory momentum with regards to climate risk represents fuel for the Megatrend: Clean Energy Finance.

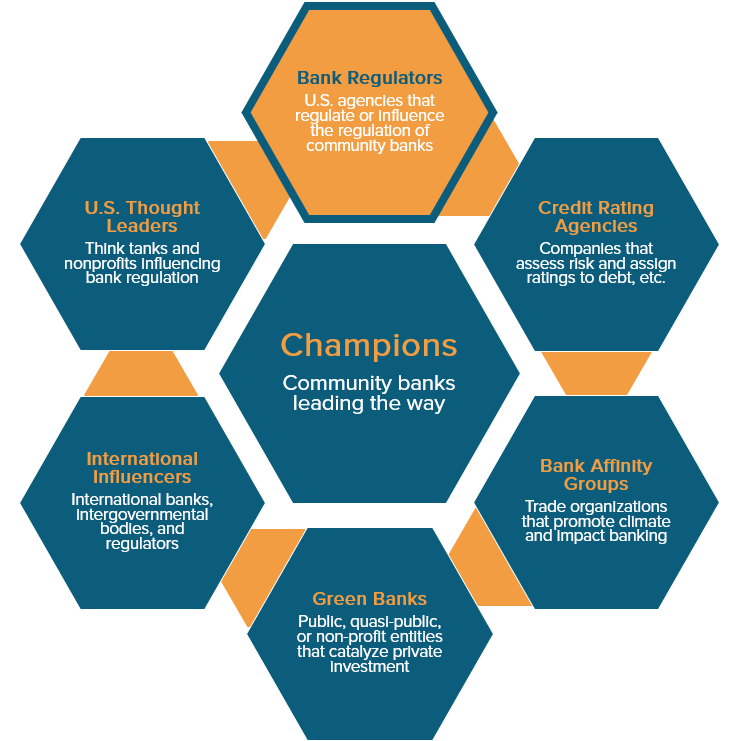

Players Shaping Community Banks Financing of Solar

White House Climate Risk Roadmap

In October, the White House issued A Roadmap to Build a Climate-Resilient Economy. The roadmap lays out a ‘Climate Risk Accountability Framework’ and a ‘Whole-of-Government Implementation Strategy to Address Climate-Change Related Financial Risk.’ With emphasis on “promoting the resilience of the U.S. financial system to climate-related financial risks” and “protecting vulnerable and disadvantaged communities”, the roadmap is indicative of the Executive Branch’s stance on regulating banks’ climate-risk exposure.

“The Federal Government has an important role to play in setting a floor for voluntary, regulatory, and public management action to protect U.S. fiscal and financial health.”

- A Roadmap to Build a Climate-Resilient Economy.

The OCC, SEC and FSOC Start to Move on Climate Risk Regulation

In July, the Office of the Comptroller of the Currency created the new role of Climate Change Risk Officer to ensure banks are adequately managing the risks climate change poses to their business. After a decade of little movement, in 2021 the Securities and Exchange Commission (“SEC”) also began taking the risk seriously. Their actions to date include:

1. SEC Chairman Gensler noted that 75 percent of the comment letters responding to a March 15 request for comment supported mandatory climate change disclosure rules.

2. Chair Gensler directed SEC staff to develop a mandatory climate risk disclosure rulemaking plan for SEC consideration by the end of the year.

3. Chair Gensler asked his staff to consider whether climate risk disclosures should be filed as part of a company’s Form 10-K.

By mid-October, the Financial Stability Oversight Council (“FSOC”) published a 129-page report, titled FSOC Report on Climate-Related Financial Risk, on how Bank Regulators should incorporate climate risk management into the regulatory system. Led by Treasury Secretary Janet Yellen, this report offers detailed recommendations with respect to oversight, data collection, disclosures, and risk assessment. Yellen and her council have further set the stage for more specific bank regulatory actions.

What Does This Mean for Community Banks?

Despite this burst of activity, it could be a few years or more before meaningful climate-risk related bank regulations are promulgated. Regardless, community banks are already taking immediate action to position their portfolios for a better energy future.

Largest community solar project in New York City completes installation of 1.8MW of solar arrays across 27 rooftops, with NYCHA residents helping to power the solar team

In the coming weeks, we will feature several community bank Champions, beginning with Cape Cod 5, that have a track record of climate investing because it builds resilient communities and provides solid risk adjusted returns. In addition, clean energy finance prepares their balance sheets for climate-risks and related regulations. Sunwealth will continue to highlight the Bank Regulators and other players as further action unfolds.

Upcoming Event: Banker’s Renewable Energy Summit

In the meantime, don’t pass up the opportunity to learn about the benefits of community-based clean energy investing directly from your community banking peers at the 2021 Banker’s Renewable Energy Summit on Thursday, December 9, 2021, from 9:30am – 12:00pm via Zoom.

Attendees will learn firsthand about the benefits of investing in clean energy from banking peers at Needham Bank and Coastal Heritage Bank, with special guest host Malia Lazu - Founder and CEO, The Lazu Group, MIT Sloan School of Management Lecturer, and former Regional President of Berkshire Bank--leading the conversation.

Sunwealth puts money to work in exactly the sort of projects we’ll be discussing. Learn more by reaching out to Darreck Mitchell, Director of Capital Markets at darreck@sunwealth.com.