20. Clean Energy Finance: Introducing the Players Shaping the Role of Community Banks

“Community Banks are positioned to be leaders in and benefit greatly from the megatrend, clean energy finance.” – Darreck Mitchell, Sunwealth

by Darreck Mitchell and Andrew Hollander

Over the next few months, Sunwealth’s Banking on Solar content will focus on the players shaping the role of community banking and their approaches to shape, catalyze, and capitalize on impactful clean energy finance.

A Trend Becomes a Megatrend: Clean Energy Finance

Often, there are trends, and then, less often, there are megatrends. Climate change is an enormous problem staring the U.S. economy directly in the face. Lenders of capital are starting to recognize an immense financial opportunity on which they’re well-positioned to seize.

In 2021, U.S. renewable and energy efficiency investment will exceed $50B for the first time. Over half of these dollars flowed to solar projects. Within the next 20 years, community-based solar investment is expected to reach $500B as the cost of renewables declines and climate policy incentivizes growth.

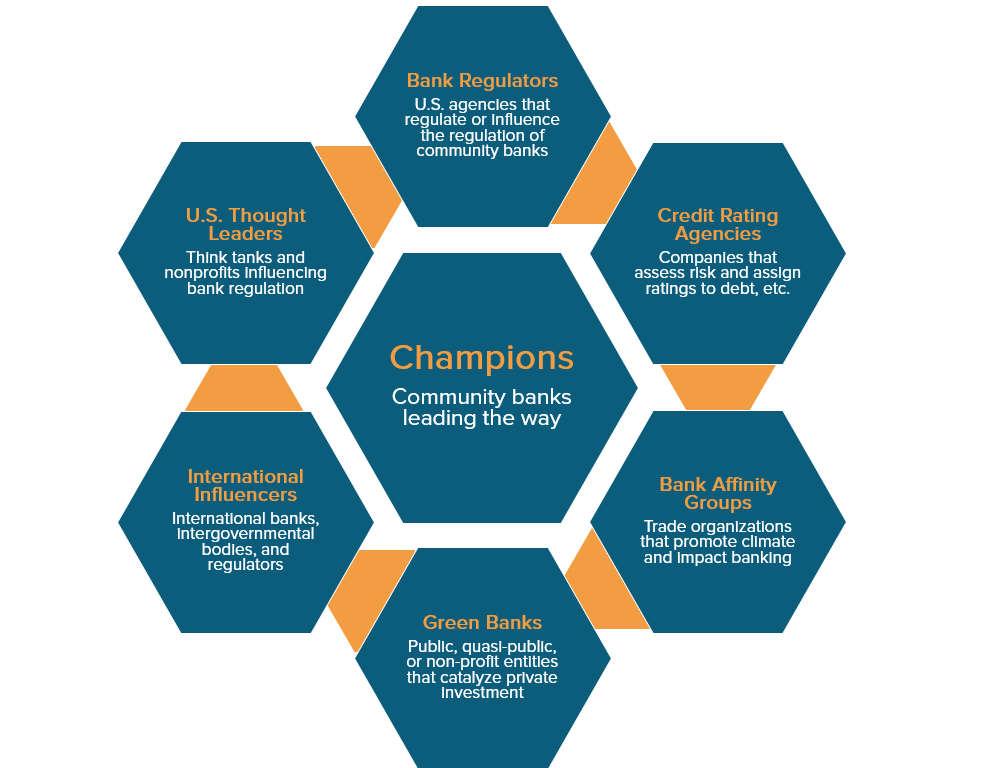

A burgeoning number of community banks - we call them Champions - have already begun investing in community-based solar. These banks are well-positioned to grow, develop, and lead as clean energy finance emerges as a dominant megatrend. In doing so, bankers build more resilient communities, develop robust brands and expertise, enhance their financial performance, and position themselves strategically ahead of dawning policy changes.

Other banks remain on the sidelines, preparing or awaiting regulatory guidance.

Players Shaping Community Banks Financing of Solar

The clean energy finance megatrend is driven by climate change and the understanding that renewables are a highly investable asset class. At the local and regional level, it will also be driven by how quickly, at what scale, and how impactfully essential players - including Champions, bank affinity groups, regulators, credit rating agencies, and other influencers - decide to act.

What Comes Next?

In upcoming installments, we will examine the regulator’s recent reports and policy statements. One such report is a product of Executive Order 14030, A Roadmap to Build a Climate-Resilient Economy, which serves as a roadmap to “catalyze public and private investment to seize the opportunity of a net-zero, clean energy future.” Soon after, we will showcase the regional bank vanguards as they continue to make debt and tax equity investments in community-scale solar projects.

Climate change and climate investing are all over the headlines as global financial institutions and Fortune 500 companies stake their claim in this niche. With Banking on Solar, we’ll focus on the policies, the people, and the playbooks most relevant for community bankers. Please read the Wall Street Journal or the trade news for coverage of climate change science, technology, and the clean energy policy that has opened the flood gates of clean energy finance.

At Sunwealth, we see regional bankers playing a vital role in the local solar economy. The smart money has a shot to capture market share in a sturdy sector of clean energy that will shape our economies for generations to come. We’re here to facilitate the investment - provide analysis that makes sense of the trends – and provide practical examples of transactions that bolster balance sheets even as they improve carbon budgets.

Learn more about how Sunwealth could put your money to work by reaching out to Darreck Mitchell, Director of Capital Markets at darreck@sunwealth.com.

Darreck Mitchell is Director of Capital Markets at Sunwealth. He has over a decade of experience in financial services, sales management, and asset management distribution. When he’s not helping investors put their money to work, he can be found spending time with his wife and two young daughters.

Andrew Hollander joined Sunwealth as an Associate shortly after graduating from Bentley University. He is amped to put his degree to work and motivated to create a clean energy future for all. When he’s not managing solar assets, he can be found spending time outdoors with friends and family.